ETH Price Prediction: Path to $5,000 Amid Bullish Technicals and Strong Fundamentals

#ETH

- Technical Momentum Building: MACD showing positive divergence despite current price trading below 20-day MA, suggesting underlying strength

- Institutional Accumulation Accelerating: Major players including SharpLink Gaming and Bitmine significantly increasing ETH holdings, providing substantial buying pressure

- Fundamental Catalysts Emerging: Pectra upgrade optimism and validator queue flipping to net inflows creating positive sentiment foundation for price appreciation

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Signals Despite Short-Term Pressure

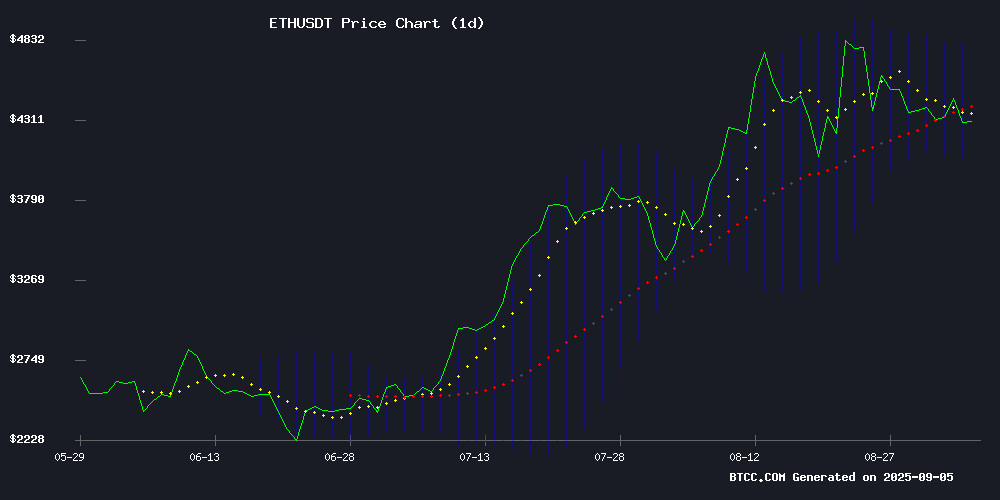

ETH is currently trading at $4,325.36, below its 20-day moving average of $4,432.39, indicating some near-term weakness. However, the MACD reading of 36.49 suggests building bullish momentum, while the Bollinger Bands position shows ETH trading closer to the middle band than the lower band, providing room for upward movement toward the $4,807 upper resistance level.

According to BTCC financial analyst Emma, 'The technical setup suggests consolidation above $4,000 could provide a foundation for testing higher levels. The MACD positive divergence is particularly encouraging for bulls looking toward the $5,000 threshold.'

Market Sentiment: Institutional Accumulation and Upgrade Optimism Support ETH

Recent news flow surrounding ethereum reveals strong institutional interest despite market volatility. Major developments include SharpLink Gaming expanding its ETH treasury to 837K tokens, Ethereum whales accumulating 14% more ETH, and Bitmine adding $65.3 million in Ethereum exposure.

BTCC financial analyst Emma notes, 'The combination of institutional accumulation, validator queue flipping to net inflows, and Optimism around the Pectra upgrade creates a fundamentally supportive environment. While short-term volatility persists, these developments suggest underlying strength that could propel ETH toward higher levels.'

Factors Influencing ETH's Price

Ethereum Bulls on the Back Foot – Can Momentum Return Soon?

Ethereum's price shows tentative signs of recovery after establishing a base above $4,220, mirroring Bitcoin's recent trajectory. The cryptocurrency managed to breach the $4,300 and $4,350 resistance levels before encountering renewed selling pressure.

A bearish trend line has emerged on the hourly chart, capping gains NEAR $4,370. The 100-hourly Simple Moving Average currently acts as dynamic resistance, with the market awaiting a decisive close above $4,450 to confirm bullish momentum.

The recent price action formed a swing low at $4,269, with ethereum now testing the 23.6% Fibonacci retracement level of its decline from $4,488. Market participants are watching the 50% retracement level near $4,370 as the next critical resistance point.

SharpLink Gaming Expands Ethereum Treasury Holdings to 837K ETH Amid Market Uncertainty

Ethereum maintains its footing above $4,200 despite persistent resistance at the $4,500 threshold. Bulls have struggled to catalyze a decisive breakout, leaving investors wary of profit-taking and volatility following ETH's recent highs.

Institutional demand emerges as a counterbalance. SharpLink Gaming, a Nasdaq-listed pioneer in corporate ETH treasury strategies, acquired 39,008 ETH at ~$4,531 this week. The firm now holds 837K ETH worth $3.6B, underscoring growing institutional recognition of Ethereum as a reserve asset.

The divergence between price action and accumulation trends highlights ETH's unique market position. While technical resistance persists, robust fundamentals and corporate adoption provide structural support. Market participants await either a momentum-driven breakout or a deeper retest of support levels in coming weeks.

MAGACOIN FINANCE Presale Surges to $1M in Five Days Amid Retail Investor Frenzy

MAGACOIN FINANCE, an Ethereum-based project, has raised $1 million in its presale within five days, capturing significant attention from retail investors. The rapid sell-out of presale stages reflects growing demand, driven by early-buyer incentives and a capped token supply. Analysts note the project's momentum could signal a price surge post-presale.

Security remains a cornerstone of MAGACOIN FINANCE's appeal. A comprehensive audit by HashEx confirmed the smart contract's robustness, while KYC-verified developers bolster transparency. Open-source documentation further solidifies investor confidence in the project's legitimacy.

The current presale price stands at $0.00043863, with a final entry point set at $0.00054. Market observers anticipate heightened volatility as the presale deadline approaches, with retail participation outpacing initial projections.

Ethereum Whales Accumulate 14% More ETH Amid Price Rally Toward $4,500

Ethereum's march toward reclaiming the $4,500 level comes as on-chain data reveals sustained accumulation by deep-pocketed investors. Mid-sized whales holding 1,000-100,000 ETH have increased their positions by 14% over five months, with notable buying activity during ETH's consolidation between $1,400-$1,800.

Santiment's tracking shows this accumulation trend aligns with Ethereum's broader price recovery. Analysis from Altcoin Vector indicates mega whales (10,000+ ETH) and large whales (1,000-10,000 ETH) particularly accelerated purchases between mid-July and August, coinciding with the development of Ethereum's current upward momentum.

The altcoin's ability to sustain its breakout from bearish compression now hinges on whether this whale activity persists. Market observers note that a decisive push beyond the $5,000 all-time high WOULD likely require renewed accumulation from these key investor cohorts.

Ethereum Validator Queue Flips to Net Inflows Amid Institutional Accumulation

Ethereum's validator entry queue has surpassed exits for the first time since July, signaling renewed confidence in the network. The entry queue hit a two-year high of 860,300 ETH this week, while the exit queue declined to 822,700 ETH from August's peak of 1.05 million. This reversal alleviates concerns about potential sell pressure from mass unstaking events.

Institutional players like BitMine and SharpLink are driving the accumulation trend, with ETH currently trading around $4,300. The breach of an ascending trendline puts the $4,100 support level in focus as market participants watch for the next directional move.

Bitmine Adds $65.3M in Ethereum Amid Market Volatility

Ethereum demonstrates resilience, holding above $4,200 despite mounting selling pressure. The asset struggles to breach the $4,500 threshold—a key level that would signal a sustained uptrend. Profit-taking and broader market uncertainty have left traders cautious about near-term price action.

Institutional demand remains a bullish counterweight. Bitmine, a major player, acquired an additional $65.3M worth of ETH, reinforcing confidence in long-term fundamentals. Analyst Ted Pillows notes this aligns with a broader rotation into Ethereum even as altcoins face steeper corrections.

The ETH/BTC performance divergence suggests Ethereum may outperform during market turbulence. Whale accumulation and structural demand at current levels could catalyze a breakout if the $4,500 resistance is decisively overcome.

Ethereum’s 2025 Rally Toward $10K Faces Competition from Ozak AI’s Ascent

Ethereum’s projected surge to $10,000 by 2025 is drawing attention, but Ozak AI’s presale momentum suggests a rival narrative. The AI-powered project has raised $2.6 million and sold 840 million tokens at $0.01, with listings on CoinMarketCap and CoinGecko already secured. Audits and institutional interest position it as a high-upside alternative to ETH’s steadier growth.

Ethereum’s technical resistance lies at $4,600, $5,200, and $6,000—key levels to watch for confirmation of its long-term rally. Meanwhile, Ozak AI’s lower market cap and presale traction hint at exponential potential, redirecting speculative capital from established LAYER 1 assets.

Grayscale Launches Ethereum Covered Call ETF to Generate Income from ETH Exposure

Grayscale Investments expanded its crypto income strategies with the launch of the Grayscale Ethereum Covered Call ETF (ETCO). The actively managed fund systematically writes call options on Ethereum-linked exchange-traded products, aiming to provide biweekly distributions while maintaining ETH price exposure.

"This ETF complements existing Ethereum holdings by adding an income component through option premiums," said Krista Lynch, Grayscale's Senior VP of ETF Capital Markets. The product targets investors seeking cash flow from their crypto allocations without liquidating positions.

The launch signals growing institutional sophistication in cryptocurrency markets, with Grayscale building on its established Bitcoin trust products. ETCO's strategy mirrors covered call approaches used in traditional equity markets, adapted for Ethereum's volatility.

Ethereum Surges Past $4,000 Amid Pectra Upgrade Optimism

Ethereum's native token ETH breached the $4,000 psychological barrier in early August, marking a 28% monthly gain as of September 3. The asset now trades merely 10% below its all-time high, with market structure suggesting potential for further upside.

The rally coincides with Ethereum's Pectra upgrade implementation on May 7. Key enhancements include temporary smart contract functionality for standard wallets and increased validator balance ceilings - technical improvements that streamline operations and bolster capital efficiency across the network.

Market participants interpret these developments as fundamental strengthening of Ethereum's value proposition. The upgrade's dual focus on user experience and validator economics appears to be driving renewed institutional interest in the blockchain's native asset.

1inch’s Swap API Opens Access to Tokenized Real-World Assets

1inch has upgraded its Intent-based Swap API to support tokenized real-world assets (RWAs), a significant move toward integrating traditional finance instruments into decentralized finance workflows. The enhancement allows eligible users—excluding those in restricted jurisdictions like the U.S.—to access RWAs through the 1INCH dApp, Wallet, and partner platforms leveraging the Swap API.

The upgrade addresses fragmented liquidity, a major hurdle in RWA adoption. By incorporating RWA execution into 1inch’s aggregation and routing logic, users can now swap tokenized equities, ETFs, and similar assets with the same efficiency as native crypto tokens. Professional market-making engines, termed 'resolvers,' handle execution to ensure a seamless experience.

Ondo Finance, a leader in tokenized assets, partnered with 1inch for this integration. Ondo’s newly launched ONDO Global Markets offers over 100 tokenized assets on Ethereum, with plans to expand to 1,000 by year-end. 1inch’s Swap API serves as the core execution layer for these assets.

Trust Wallet, a recent adopter of 1inch’s technology, has already integrated the feature, extending access to its large user base.

Ethereum Advocacy Group Etherealize Raises $40M to Bring ETH to Wall Street

Ethereum-focused firm Etherealize has secured $40 million in fresh funding, led by Electric Capital and Paradigm, to accelerate institutional adoption of the second-largest cryptocurrency. The raise comes as public firms collectively add over $1.2 billion worth of Ether to their treasuries—a clear signal of growing Wall Street interest.

Launched in January with backing from the Ethereum Foundation and Vitalik Buterin, Etherealize aims to bridge the gap between Ethereum's technical ecosystem and traditional finance's demand for regulatory-ready infrastructure. Co-founder Grant Hummer notes that despite ETH's presence in crypto ETFs, many institutions still lack fundamental understanding of the asset.

The capital will fund development of tokenized asset settlement systems and Ethereum-based financial tools, positioning ETH as a cornerstone of institutional crypto strategies. This institutional push coincides with Ethereum's ongoing transformation into a yield-bearing asset through staking mechanisms.

Will ETH Price Hit 5000?

Based on current technical indicators and market developments, ETH has a reasonable chance of reaching $5,000 in the medium term. The current price of $4,325.36 needs to overcome several resistance levels, but strong institutional accumulation and positive technical momentum provide supportive conditions.

| Key Levels | Price (USDT) | Significance |

|---|---|---|

| Current Price | 4,325.36 | Base level |

| 20-Day MA | 4,432.39 | Immediate resistance |

| Bollinger Upper | 4,807.70 | Next major resistance |

| Target Level | 5,000.00 | Psychological barrier |

BTCC financial analyst Emma suggests that 'while the $5,000 target is ambitious, the combination of technical recovery potential and strong fundamental drivers makes it achievable within the current market cycle, though timing remains uncertain given market volatility.'